On this charming article, we delve into Right here’s how a lot cash you’ll get with the Inflation Discount Act, a masterpiece crafted by Michelle Lewis and revealed on 2023-12-15 00:44:54. Discover the world of Auto Excellence and uncover what units Autoxyon aside.

The Inflation Discount Act (IRA) is a “free electrical checking account along with your identify on it.” It’s full of rebates and tax credit that may assist People buy all the pieces from EVs to photo voltaic and electrical home equipment to warmth pumps. Take a look at this easy-to-use IRA financial savings calculator from Rewiring America that tells you what you get – and when.

Rewiring America is an electrification nonprofit whose “function is to make electrification easy, measurable, and inevitable.” We upgraded to a 200-amp service panel and had rooftop photo voltaic and Tesla Powerwalls put in within the fall, so this financial savings calculator has been, and can proceed to be, a precious instrument for us. (We’re saving up for a warmth pump.)

I used to be in a position to verify (and subsequently reconfirm) in seconds that we will declare a 30% tax credit score for photo voltaic, a 30% tax credit score for battery storage set up, and a 30% tax credit score, capped at $600, for our electrical panel improve.

We purchased a US-made 2023 Volkswagen ID.4 in late 2022, and the Rewiring America calculator confirmed that our automotive certified for the complete $7,500 tax credit score earlier than we accomplished the acquisition.

In my electrification journey, I’ve discovered that I have to do my very own analysis and advocate for myself, as electricians, warmth pump installers, and Automobile Dealerships are nonetheless studying about how the brand new tax credit and rebates work. Most of the time, I fill them in. (Then I share what I be taught with you – that is my job, in spite of everything.)

The parents who’re serving to us to affect need to know in regards to the IRA rebates and tax credit, and so they appear to genuinely need to assist me in flip.

Inflation Discount Act rebates

On July 27, 2023, the US Division of Vitality (DOE) rolled out tips for states, territories, and the District of Columbia to use for his or her share of $8.5 billion in electrification and power effectivity rebates offered by the IRA. That funding goes to save lots of customers some huge cash on dwelling enhancements and electrical energy payments.

Rebates embrace dwelling electrification and equipment rebates that may act as fast reductions on the level of sale for low- and moderate-income households when making qualifying electrification purchases.

There’s additionally the dwelling effectivity rebates program that rewards modeled power financial savings of a minimum of 20% or measured power financial savings of a minimum of 15%. So, when you save a certain amount of power and have receipts, then you definitely get a rebate. It’s not income-capped, however a minimum of half of this system’s funding will go to low-income households.

DOE Deputy Secretary David Turk mentioned in August that the DOE expects that “these rebates will begin to be obtainable to customers in some states as early as the top of this 12 months and persevering with on a rolling foundation in 2024.”

Rewiring America has a disclaimer on its Inflation Discount Act financial savings calculator web page about state rollouts:

The rebates could also be applied in a different way in every state, so we can’t assure closing quantities, eligibility, or timeline.

The ‘Smith household’

The tax credit are prepared now, so it’s price familiarizing your self with the IRA financial savings calculator. Right here’s the way it works: Sort in your zip code, home-owner standing (renters qualify, too), family earnings, tax submitting standing, and family dimension into the IRA Financial savings Calculator, and click on “Calculate!”

It then shows your personalised incentives and splits out tax credit from upfront reductions (i.e., rebates).

I created the “Smith household” as a case research: a household of 5, home-owner, family earnings of $120,000, head of family tax submitting, zip code 19352 (that’s Pennsylvania).

The calculator says the Smiths will qualify for rebates in 2024, and so they qualify for $15,600 in obtainable tax credit immediately, which implies they’ll declare these tax credit on their 2023 taxes, in the event that they bought rooftop photo voltaic or an EV earlier than December 31. (It’s too late for photo voltaic tax credit now for 2023 when you haven’t already put in it, however there are some nice end-of-year EV offers, together with from Tesla.) They’ve an estimated power financial savings per 12 months of $1,500, the latter of which is predicated on power prices in Pennsylvania.

Rebates – what Rewiring America calls “upfront reductions” – are based mostly on a share of space median earnings, and the Smith’s space median earnings is $114,400, as they dwell within the 19352 zip code space. (Yow will discover your space median earnings utilizing this Space Median Revenue Lookup Instrument from Fannie Mae.)

So meaning when the rebates are rolled out in Pennsylvania subsequent 12 months, the Smiths are going to qualify for some good ones. Right here’s what they’d get for an induction range as a moderate-income family, for instance:

For low-income households (below 80% of Space Median Revenue), the Electrification Rebates cowl 100% of your electrical/induction range prices as much as $840. For moderate-income households (between 80% and 150% of Space Median Revenue), the Electrification Rebates cowl 50% of your electrical/induction range prices as much as $840.

Residence Depot sells induction ranges for between $1,000 and $3,000. If the Smiths opted for a lower-cost mannequin – Samsung makes one for $1,098 – then their brand-new induction vary could be below $500. (As an apart, when you’ve by no means cooked on an induction vary earlier than, it’s improbable. It’s like a fuel range with out the emissions, and also you couldn’t burn your self on it when you tried.)

Rewiring America additionally offers an easy-to-understand on-line information to the IRA known as “Go electrical! (now).” You’ll be able to entry that right here.

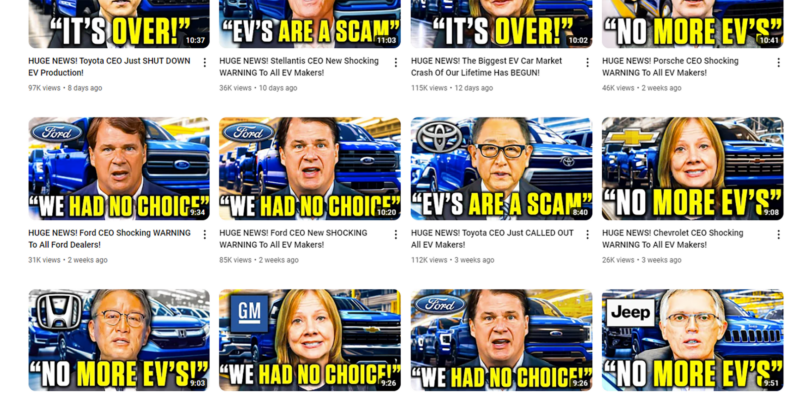

Learn extra: EVs with Chinese language components gained’t qualify for the complete $7,500 tax credit score from 2024

To restrict energy outages and make your own home extra resilient, take into account going photo voltaic with a battery storage system. With the intention to discover a trusted, dependable photo voltaic installer close to you that provides aggressive pricing, take a look at EnergySage, a free service that makes it simple so that you can go photo voltaic. They’ve lots of of pre-vetted photo voltaic installers competing for what you are promoting, making certain you get high-quality options and save 20-30% in comparison with going it alone. Plus, it’s free to make use of, and also you gained’t get gross sales calls till you choose an installer and share your telephone quantity with them.

Your personalised photo voltaic quotes are simple to check on-line, and also you’ll get entry to unbiased Vitality Advisers that will help you each step of the best way. Get began right here.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.

Be a part of us on this journey of Automotive discovery as we uncover the newest insights from Electrek. Whether or not you are an auto fanatic or an off-the-cuff reader, there’s one thing right here for everybody.

[ad_1]

For extra particulars, go to https://electrek.co/2023/12/14/inflation-reduction-act-calculator/ or click on . You will not need to miss this!

[ad_2]

Keep tuned for extra thrilling updates from Autoxyon. Do not forget to comply with us for the newest information and insights.

Uncover Extra:

Discover different thrilling ventures from Xyon Enterprises:

XyonEnt.com: Your gateway to a world the place Innovation intertwines with boundless Creativity, delivering revolutionary enterprise ventures and a treasure trove of charming data.

autoxyon.com: Embark on a journey into the way forward for Vehicles, the place you will discover the newest updates, professional critiques, and profound insights into the Automotive business.

affiliateninjaxyon.com: Unleash your interior Affiliate Advertising ninja at The Affiliate Ninja Hub, the place you will grasp the artwork of Affiliate Packages and unlock extraordinary procuring experiences.

channyswigshop.com: Unveil your interior magnificence with a curated assortment of stylish Wigs, top-tier Hair Care merchandise, and a variety of Magnificence Equipment.

cyberxyon.com: Dive headfirst into the Digital Age by exploring Reducing-Edge Electronics and Tech Marvels that redefine Fashionable Residing.

cryptoxyon.com: Navigate the thrilling and ever-evolving panorama of Cryptocurrencies and Blockchain expertise, staying forward with Knowledgeable Insights into the Crypto Revolution.

DecaTrendz.com: Elevate your sporting prowess with top-quality Sports activities Tools, gear, and equipment, setting the stage for Sporting Excellence.

investxyon.com: Craft your path to wealth via the intricate world of Investments, armed with methods and invaluable insights for monetary success.

NovaXyon.com: Immerse your self within the limitless potentialities of Web Advertising and achieve Trade Insights that gasoline your on-line endeavors.

xyonpaw.com: For Pet Fans, our sanctuary gives profound insights, curated Pet Merchandise, and a loving group to nurture these furry bonds.

ZenXyon.com: Embrace holistic radiance by discovering the harmonious mix of aware residing, invigorating Train, nourishing meals, and Wellness Knowledge.

#Heres #cash #youll #Inflation #Discount #Act

Leave a Reply

You must be logged in to post a comment.